A Time Of Reckoning For Used Car Markets!

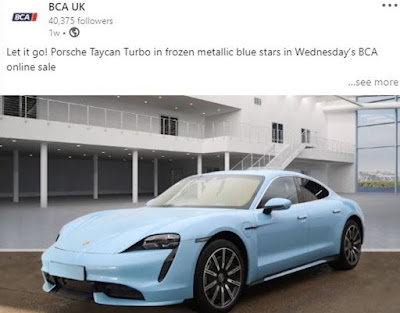

Well they say that a picture paints a thousand words and the image above certainly tells those looking and those capable of reading “The Signs” an awful lot about the state of the Automotive Sector in the UK; both in terms of where some used car markets (and prices) are heading and the associated levels of expertise contained within the sector itself.

In truth and to those that understand the associated used car markets, the image above is a worrying indictment of both the associated used car market, the Automotive Sector itself and the lack of prerequisite expertise in some used car markets. Be in no doubt though, images like this will cause some problems for certain used car markets in the UK, especially specialist and high performance used car markets.

And do not think this is an isolated case, in truth I could have used one of many images from Lamborghini’s to Rolls Royce’s to make this point; it is the volume of specialist high performance used car stock appearing at BCA (including their social media feeds) that is concerning.

So let’s cut immediately to the chase; specialist high performance used car stock (like the Porsche Taycan in the image above) should NEVER be appearing in BCA Auctions, (or any non-manufacturer closed auction for that matter), on their social media feeds or on their website. Those responsible for sending this car here may be many things (professionally), but capable of operating successfully within the used car markets catering for stock like this, they certainly are not!

Yet, and despite all this, I understand how the Automotive Sector has got to here. “Here” being the constant elevation of BCA as an organisation. From the “Toilet” where businesses should be sending all their crap and their mistakes, to the perception of being a premium retailer/supplier of specialist high performance used car stock holdings; and all for free. Well done people, rounds of applause all round!

So in order to help those deluded enough to think that sending specialist high performance used car stock (like this) to an auction like BCA is a good idea, let me enlighten you as to what those who operate in the associated used car markets, take from the image above.

Firstly, the car in the image above is now the car that will never be purchased by those knowledgeable about, and operating within, the associated used car market. Word spreads very quickly in the specialist high performance used car markets and no one wants to purchase the stock that has been prostituted, and within the wrong circles. So if the dealer taking the car in part exchange or looking to dispose of the car because it is overage used car stock, was looking to achieve market value, this is now highly unlikely. In fact (in reality) all they have achieved is having to make their example the cheapest available in the country, if it is to be liquidated.

To be fair, the car could be here because of the unhealthy adherence (unhealthy that is, for all those businesses advocating the ridiculous policy) to an “All Auction” disposal policy. Now I will not use this article to revisit the trading lunacy of “All Auction” disposal policies, I have covered this subject many times in the articles written for my Used Car Business Development Blog; the articles below being just a few of them.

For context though, and in brevity; “All Auction” disposal policies were a work of genius by no one, apart that is from the Auction companies themselves. Their uptake caused the majority of genuinely successful used car professionals (those capable of handling specialist high performance used car stock like this) to leave the employ of franchised dealer networks. To such a degree that franchised dealer networks are now hooked to Auctions as an outsourced resource supplier; one doing the jobs they should be doing themselves, rather than giving a business away for free!

So back to image and the car concerned, what does it tell me? It tells me two things; not only that the dealer/organisation/individual concerned does not possess the skills and experience required to operate within the associated used car market, it also tells me that the market for the car is overheated, over supplied and about to see some price correction; why?

Well, the first thing a professional who is capable of operating within the used car markets involved does, (upon seeing images like this), is ask important questions. The first being why did this happen? Followed very quickly by, if I was in the market to purchase a car like this, what is the genuine availability and what does that mean for prices; that outside of all the narrative and hype peddled on prices by Autotrader, EBay Motors, Cap HPI, etc.

Well, I will let the images below set the scene; the first from the Porsche Approved Used Car website and the second taken from the “Blind Leading The Blind” guide to used car values, and the platform that should never be used by people and/or organisations with high performance specialist cars to sell; Autotrader.

Autotrader

As you can see (as much as there may be a little overlap) there are currently 185 used Taycan’s listed for sale on the Porsche Approved Used Car website and 267 on Autotrader; that’s 452 in total!

I can also ascertain that the cheapest “Advertised” (key word; “Advertised” does not mean that the car will sell for this value – anything but) price for a Taycan in the UK is currently £82,490; please see the image above.

So both the volume of stock available and the socio-economic profile of the buyer for cars like this, tells me that the market is massively over provided for at the moment.

So, regardless of new car production delays, it is a buyer’s market for Porsche Taycan’s at the moment. And then we come to the one sitting at BCA, the one being (very unhelpfully) over exposed by BCA themselves; when (unless it is a Cinch car that is not selling – which of course it won’t) they do not even own the vehicle. This is what happens (Accountants and Senior Directors, those that have never run used car businesses) when you agree to enter “All Auction” disposal arrangements with organisations lacking in the experience and expertise required. Your car now becomes the cheapest in the country; if (that is) it can be sold at all?

Now to add context, let me explore this argument; you ring me to buy the car, I point out all the above, and the fact that it is at BCA, so every professional possessing the experience and expertise required, now knows about the car and the fact that it hasn’t (yet, and at the time of writing this article) been sold. I would advise that the car advertised at £82,490 sets market value, which is actually far below this in reality, because there is too much stock; supply and demand will now be driving prices down.

I respectfully point out that in a market of 452 used Taycan’s, the last thing any retail customer interested in the car has to do, is pay the asking price. If I was interested in purchasing a Porsche Taycan I would tell the dealer that I will contact every one of the 18 examples currently advertised at under £90,000 and offer 10% below the asking price, knowing full well that one of them will have no other option than to accept.

I would probably ring the one advertised at £82,490 (the cheapest) first when the conversation would be quite simple. It would proceed along the lines of this; I will offer you £72,500 for the car (this will probably not be accepted but I will use this to flush out their best price) and advise that I will give them an hour before ringing the next cheapest example and making an offer for that. So don’t hang around, if it’s longer than an hour I will have probably moved on.

Unfortunately, and as much as this supply and demand imbalance can occur in all used car markets, in specialist and high performance used car markets the ramifications of an over supplied market are far more damaging for real prices. There are far fewer buyers and those who are in the market, tend to be far more knowledgeable and more successful in their professional lives.

So what does this mean for the business or the individual who was foolish enough to send the car to BCA. Well we end up here; I’m pretty confident that the car advertised at £82,490 could be purchased for £75,000 - £77,500 and in a market with 452 examples currently available for sale, if I was to invest in the car (as a retail opportunity and because I wanted to have the 453rd example available in the UK) it would have to be the cheapest. Would I bid £70,000? Absolutely not! I would guess that in this over supplied market, fear will have taken hold and most of the competition will now not be buying; therefore there will be little competition to own the car, so why should I?

So in reality the associated used car market probably has it’s first under £70,000 (in the trade) Porsche Taycan, and no I wouldn’t buy the car for stock. I would though work with the current owners (but only after qualification) and use their money, combined with my skills and experience, in order to find a buyer for the car. But before any of this could take place, we would have to explore all of the above; and the reasons why they have reduced the desirability and therefore the value of the car in the image.

In truth the image above and the many others that have appeared on BCA’s social media feeds recently, does nothing other than support a feeling that I have had for a while. I have suspected for a long time that there is a day of reckoning coming for prices and residual values in specialist high performance used car markets. Too many manufacturers have produced far too many cars, become overly emboldened by a market that only existed because central bankers pumped markets full of free cash during the pandemic, and whilst there was a limited supply of products to invest that money into. All of which is about to unwind and inevitably lead to the fragile (and overpriced) pricing eco-system to come tumbling down.

There is also another driver in the market that is about to unwind; the disappearance of cheap finance. Cheap finance rates combined with the creative use of PCP finance agreements, brought specialist high performance cars into the ownership aspirations of a different socio-economic group of customers. Just the profile of customer who may now be struggling to make the payments, along with increased mortgage payments and the cost of living.

Although we are only just entering the period of time when all the financial largesse of the pandemic has to be paid for, in the past this profile of customer has tended to bail out of unaffordable assets very quickly, then distressing the associated asset markets. Specialist high performance cars are no different and we must wait and see how many specialist high performance cars fall into this bracket.

My read of the market is that it will be a lot. If Autotrader is anything to go by (again though, the LAST place that specialist high performance cars should be advertised, but a useful barometer of the desperate) where there are currently 297 McLaren’s, 201 Bentley Bentayga’s and 135 Lamborghini Urus’s being advertised for sale! This is a very distressed sales and marketing message for the associated manufacturers and the used car markets concerned.

In reality any private individual or non-automotive specialist businesses looking to sell one of these cars will not be able to do so; unless it is the cheapest available, and by £Thousands. If you do not possess the specialised expertise and experience required in order to operate successfully within the market you are entering, (whether you are an automotive specialist retailer or not) the only advantage you have is the ability to attract purchasers via price. All of which will be trade buyers though; other private buyers/organisations do not tend to purchase “Big Ticket” specialist high performance cars from peoples driveways, as explored in the article below.

Now I might be wrong; the vendor may get very lucky and sell the car via BCA. It would be interesting to get the story and the full facts, including the actual price and the profile of buyer; trade or private individual. Personally I doubt it and in any evet, this information will not be forthcoming, it is not in BCA’s interest to shine the “Light of Truth” on this matter.

So where does all this leave those looking to sell a specialist high performance car? Well, in a very challenging market and trading landscape, that’s where. High levels of used car stock in specialist high performance markets, is normally the first sign that consumer confidence is evaporating, which in turn slows the rate of sales, leading to liquidity issues.

When you enter a market with little stock investment liquidity and low consumer confidence, (as we are now), only the finest most unique examples tend to find competition for purchase, thus sensible offers. For the rest the onus is on you to convince those with cash to spend that yours is the car they should be buying, which is possible, but you only have one thing to offer; a car at a price!

In market conditions like this (just those I predicted were coming, in my articles below in March and April) prices don’t correct by small margins, they correct by 10 – 20% from their previous high; and that is for the best stock, many will struggle to find offers at all. For many reading this article, those not needing to sell their car, they can afford to gamble and look to return to the market when it has stabilised at it’s new level; probably in 18 - 24 months’ time.

For those needing to sell the picture is very different and my advice is to get ahead of both the depreciation curve and market sentiment whilst (and if) you still can. This will not be palatable and/or enjoyable but if you need the money, take it now; the first offer will always be the best offer and with the market evolving as it is, procrastination will cost you £Thousands.

So with specialist high performance used car markets evolving at a pace, over supply leading to supply imbalances and liquidity in used car markets running out, where to turn now for the owners of specialist high performances cars; those looking for the right expertise and experience? That required to facilitate in the immediate liquidation of their car; a process requiring skill, expertise, the utmost discretion and excellence in execution?

Well with funds available for immediate purchase and unrivalled experience in liquidating specialist high performance cars, including the contacts base within the professional community, (both franchised dealers and the most knowledgeable specialists), you could contact me for a market consultation.

As much as I am not going to promise you for one moment that I work with every car that is offered, or with every owner that contacts me, I do choose to advise and help everyone who contacts me. In reality I can only go on to work actively with 10% of the owners who contact me; and their associated cars.

Offering immediate cash purchase, (should circumstances dictate), or the facility to act as your trusted conduit to the market, returning the best prices, I am the ultimate solution provider for those looking to dispose of their specialist high performance car.

Please feel free to reach out to me directly on LinkedIn, via email at andrewb@andrewbanningsalessolutions.co.uk or on 07500 321539; should you wish to arrange a consultation call.

Andrew.